Market developments

The ongoing market dynamics in the Netherlands are primarily shaped by volatile inflation, high interest rates, the transition to sustainable energy, and increased government regulation. In 2023, inflation, a key macroeconomic factor relevant to the housing market, was 3.8% compared with 2022, following a notable inflation rate of 10.0% in the prior year. High energy prices contributed to the Consumer Price Index (CPI) in 2022, but were notably lower in 2023 (source: Statistics Netherlands).

Inflation 2021-2023 (CPI)

Source: Statistics Netherlands

Central banks raised interest rates a number of times in 2023 as they battled burgeoning inflation. In turn, mortgage rates, rose in line with capital market rates, impacting the monthly expenses of homebuyers. Following a steep increase in interest rates in the Netherlands in 2022, the mortgage interest rates in 2023 showed more stability, fluctuating between 4% and 5%. At the end of 2023 Dutch mortgage providers like ABN AMRO, ING, and Rabobank lowered their mortgage interest rates, particularly for medium and longer fixed terms (source: Hypotheker).

Mortgage interest rate vs government bond yield NL (10 years)

Source: IEX, BLG wonen

The impact of the high mortgage rates was also reflected in a drop in owner-occupied house prices. In 2023, existing homes were, on average, 2.8% less expensive than in the previous year, marking the first time in a decade that prices were lower than the preceding year (source: Statistics Netherlands). However, in recent months the housing market regained some momentum, partly due to the decline in mortgage rates. In the fourth quarter of 2023, more homes were sold at slightly higher prices, with the average selling price some 5.3% higher than in the same period of 2022 (source: NVM).

For the investment market, the combination of high interest rates and uncertainty regarding the regulation of the Dutch housing market led to a decline in investments in rental housing, particularly among international investors. In 2023, the transaction volume in the Dutch residential investment market plummeted by 51% compared to 2022 and came in at just, €3.8 billion. Of this total, €2.3 billion was invested in new-build rental housing, equivalent to around 9,000 homes, a significant drop from the annual average of 14,500 homes over the past five years (source: Capital Value). Furthermore, the proposed regulatory changes and the uncertainty about the regulation has resulted in an increase in the privatisations of existing rental homes. The introduction of rental price regulation pushes approximately 100,000 rental homes into the home-buying market (source: CBRE).

Given the sale of rental homes and limited addition of new build homes, the housing shortage is continuing to increase, particularly in the mid-rental segment. In 2023, housing construction remained reasonably steady at approximately 70,000 homes. However, the number of building permits issued for new-build homes in 2023 was less than 55,000, representing a decline of over 15% compared with 2022 and, this is only 55% of the government target. This shortfall will contribute to an increase in the housing shortage to more than 400,000 homes in 2025 (source: Statistics Netherlands, Capital Value).

Building permits vs realised buildings 2012-2023

Source: Statistics Netherlands, Capital Value

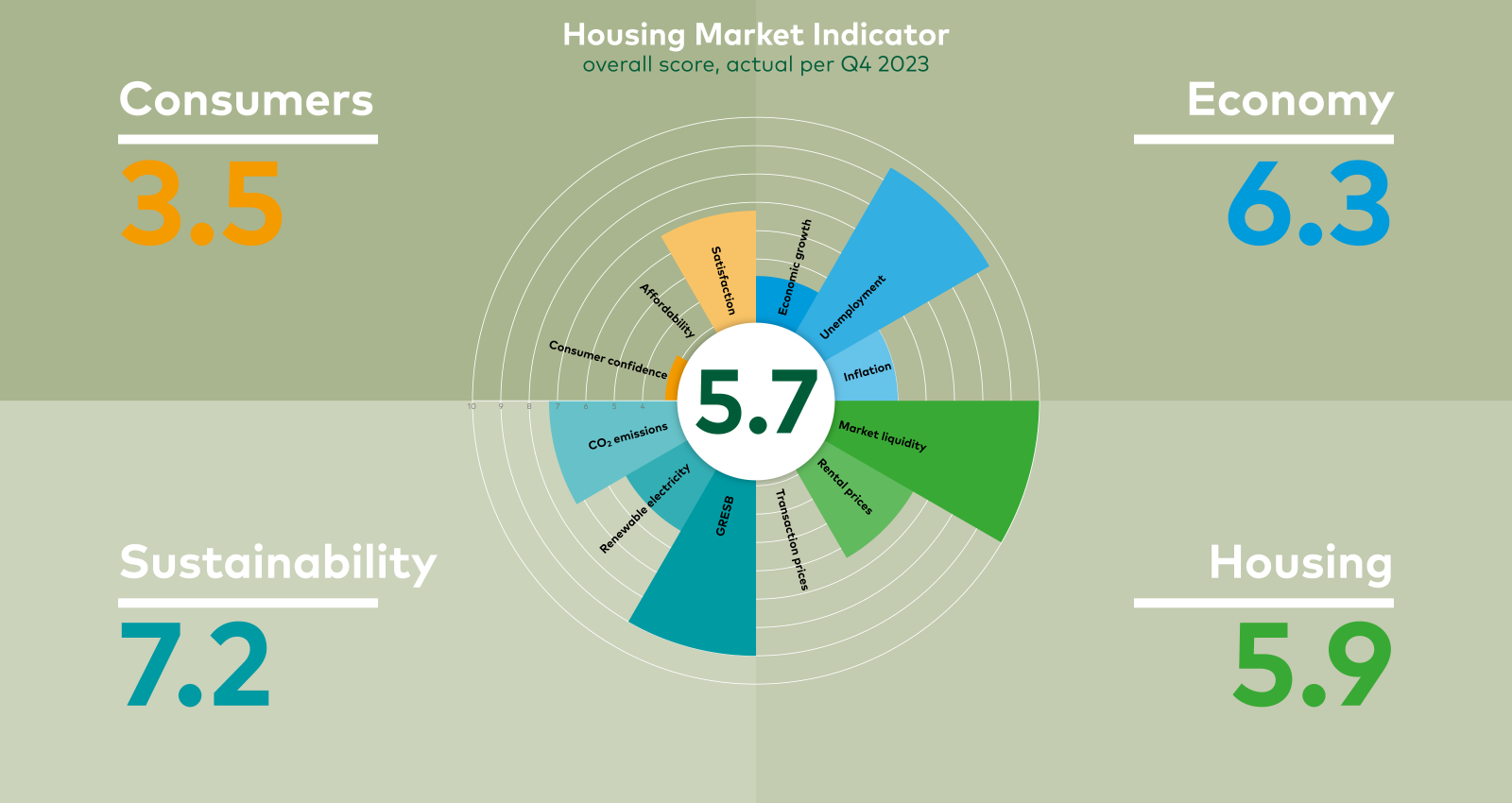

Vesteda Housing Market Indicator, actual as per Q4 2023

Source: Vesteda

Vesteda Housing Market Indicator, Q4 2020 - Q4 2023

Source: Vesteda

The above described market dynamics over the past year are further substantiated by Vesteda's Housing Market Indicator (HMI). The HMI provides an overview of the most relevant drivers on the Dutch housing market from a residential investor's perspective. In 2023, the HMI remained fairly stable around a level of 5.5 with a modest improvement to 5.7 in the fourth quarter of 2023.

Drivers such as CO2 emissions and consumer confidence saw significant score increases (+1.8 and +1.1, respectively). Furthermore, house prices are rising again, resulting in a higher score for this driver. However, in the overall score, the negative trends in renewable energy, economic growth, and affordability almost completely offset the above mentioned increases.

Despite the slight rise of the HMI, uncertainty in the housing market remains a matter of concern, partly due to the results of the national elections in late 2023.

Dutch elections & new housing regulation

The Dutch cabinet fell in 2023, resulting in new elections in November. The outcome of the elections resulted in a significant change in our political landscape. Geert Wilders, the leader of the Party for Freedom (PVV), captured 37 seats out of a total of 150, becoming the largest party in the Netherlands. Another winner was Pieter Omtzigt, who started a new party New Social Contract (NSC) and won 20 seats. The party of the current prime minister, the People's Party for Freedom and Democracy (VVD), lost 10 seats and is now the third largest party. At the time of writing this annual report, the formation of a new cabinet is in progress and it is uncertain whether it will be possible to form a (majority) coalition. Given the current political situation it is uncertain what the implications will be for the housing sector.

On 6 February 2024, the caretaker Minister for Housing, Hugo de Jonge, sent the Affordable Rent Act to Parliament, extending the rent regulation threshold to 187 WWS points, thereby increasing the regulation threshold from €880 to around €1,130 per month. Vesteda and other IVBN members and NEPROM are critical of the new housing regulation and suggested several changes. The Minister did not incorporate all our suggestions, but he did increase rents for newly built homes and increased the annual maximum rent increase in the mid-rental segment by 50 bps to collective labour agreement wage increases +1%. A few other adjustments are related to the cap on fiscal WOZ value and changes to the WWS points system. In his supporting letter, De Jonge urged Parliament to pass the bill as soon as possible, with the aim of implementing the new regulations by 1 July 2024. It is unclear whether the political parties involved in the cabinet negotiations (PVV, NSC, VVD and BBB) will support this new bill, since some have been critical of additional regulations for the housing market.

We monitor the developments closely. Our analyses of the Affordable Rent Act indicate that they will have a significant impact on the mid-rental housing market, especially in the case of small apartments in the most overstretched housing markets, if the regulated price is significantly lower than the market price. The new regulation will also impact Vesteda. Where possible, we will mitigate part of the impact, for example by investing in the quality and sustainability of our homes. We will continue with our strategy of investing in affordable and sustainable homes. At the same time, we will prepare our portfolio and asset strategies for upcoming changes.